ETH Price Prediction: $5,200 Target in Sight as Technical and Fundamental Factors Align

#ETH

- Technical Strength: ETH trading above 20-day MA with Bollinger Band support indicates bullish momentum

- Institutional Adoption: MetaMask stablecoin launch and American Express NFT integration demonstrate growing utility

- Price Targets: $5,200 near-term target supported by technical indicators and market sentiment

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

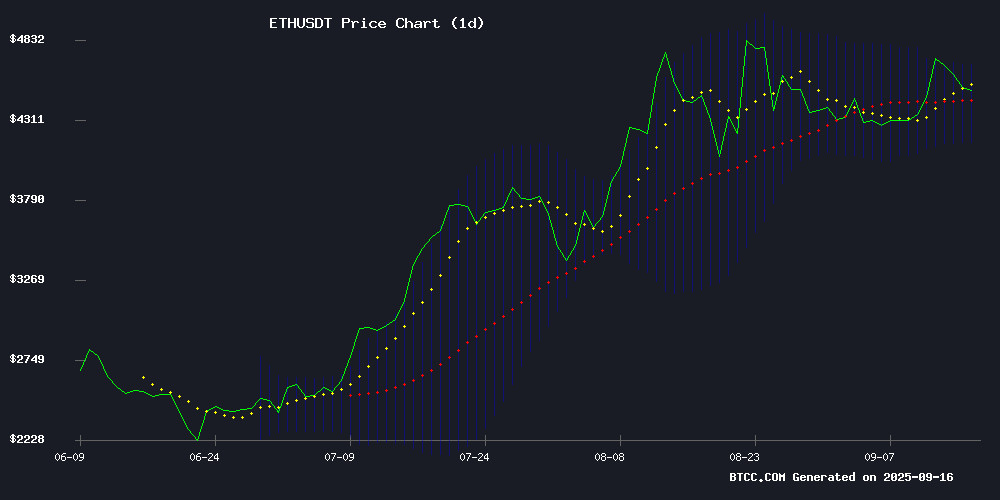

ETH is currently trading at $4,506.30, positioned above its 20-day moving average of $4,417.53, indicating underlying strength. The MACD reading of -1.86 suggests some near-term consolidation, though the overall trend remains constructive. Bollinger Bands show ETH trading in the upper portion of its range between $4,161.57 and $4,673.48, signaling potential for continued upward movement. According to BTCC financial analyst Emma, 'The technical setup supports a bullish outlook with key support at the 20-day MA and resistance NEAR the upper Bollinger Band.'

Market Sentiment: Mixed Signals Amid Institutional Developments

Market sentiment presents a complex picture with both bullish and cautious elements. Positive developments include MetaMask's mUSD stablecoin launch and American Express's NFT initiatives, which enhance Ethereum's utility. However, Citigroup's $4,300 forecast and the $12 billion exit queue introduce near-term uncertainty. BTCC financial analyst Emma notes, 'While institutional adoption continues to grow, profit-taking risks and seasonal headwinds require careful monitoring. The $5,200 price target appears achievable if current momentum sustains.'

Factors Influencing ETH's Price

MetaMask Enters Stablecoin Market with Dollar-Pegged mUSD Launch

MetaMask has introduced MetaMask USD (mUSD), a dollar-pegged stablecoin integrated directly into its crypto wallet ecosystem. The stablecoin launched on September 15, 2025, on Ethereum and Linea, MetaMask's layer-2 network, with full backing by cash and cash-equivalent assets. Issuer Bridge, a licensed entity, manages reserves under regulatory oversight.

Built using the M0 protocol, mUSD enables seamless swaps, transfers, and bridging within MetaMask's interface. Users can purchase the stablecoin via credit cards, bank transfers, or digital payment methods like Apple Pay and PayPal, with tokens delivered directly to their wallets. MetaMask also plans to integrate mUSD with its MetaMask Card, allowing spending at over 150 million Mastercard-accepting merchants worldwide.

The move comes as stablecoins prove increasingly profitable, with Tether reporting $4.9 billion in earnings during Q2 2025. MetaMask aims to position mUSD as the default stablecoin on Linea, capturing transaction volume within its growing ecosystem.

American Express Launches NFT Travel Stamps on Base Blockchain

American Express is bridging traditional finance with Web3 through its new Amex Passport initiative. The payments giant now issues non-transferable NFT travel stamps on Coinbase's Base blockchain for U.S. cardholders, marking a strategic embrace of blockchain technology by mainstream financial services.

These ERC-721 tokens serve as digital memorabilia, capturing travel destinations without storing personal data. While functionally different from tradeable NFTs, the move signals growing institutional acceptance of blockchain infrastructure. Base's selection as the issuing platform reinforces Ethereum Layer 2 solutions as preferred enterprise blockchain rails.

The stamps represent a novel use case for NFTs beyond speculative assets—focusing instead on customer engagement and brand loyalty. "As physical passport stamps disappear, this creates new ways to celebrate travel," said Luke Gebb, American Express EVP. The initiative could pave the way for more financial institutions to explore non-speculative blockchain applications.

Citigroup Forecasts Ethereum Decline to $4,300 Amid Layer-2 Dominance

Citigroup analysts project Ethereum could close 2025 at $4,300, a modest retreat from current levels near $4,515. The bank's valuation models suggest caution, with ETH trading above fundamental estimates despite bullish sentiment around scaling solutions.

Layer-2 networks now drive 70% of Ethereum's activity, creating a divergence between mainchain utility and token valuation. Citigroup outlines a bullish scenario at $6,400 should adoption accelerate, while warning of potential downside to $2,200 if scaling progress falters.

Ethereum ETF Inflows Surge Amid Cautionary Signals

Ethereum has cemented its status as the institutional asset of the moment, with $638 million flowing into its ETFs during the week of September 8-12. Fidelity's FETH fund led the charge with $381 million, marking the fourth consecutive week of positive inflows. Total assets under management now exceed $30 billion.

Beneath the bullish momentum lie warning signs. Exchange reserves have dwindled to 2016 lows while staking locks up 36 million ETH—a supply squeeze that could amplify volatility. With 99% of circulating ETH held at a profit, historical patterns suggest an impending correction. September's traditionally bearish seasonality adds further pressure.

The institutional embrace through ETFs contrasts sharply with on-chain caution. BlackRock and Fidelity's products dominate flows, yet the market faces a tension between structural demand and overheated technicals. This divergence will test ETH's ability to break free from historical patterns.

ETH Price Prediction: $5,200 Target Within 30 Days as Technical Indicators Signal Bullish Momentum

Ethereum's bullish momentum is gaining traction, with technical indicators pointing to a potential surge. The MACD shows positive divergence, while the RSI remains neutral, suggesting room for upward movement.

Analysts project ETH could test 52-week highs, targeting the $5,200-$5,255 range within the next month. This rally would mark a significant milestone for the second-largest cryptocurrency by market capitalization.

Coinbase Explores Native Token for Base Network to Boost Decentralization

Coinbase's Base network is considering the introduction of a native token to accelerate growth and decentralize governance. Jesse Pollak, founder of Base, revealed the exploratory phase during the BaseCamp event, emphasizing community involvement in the network's evolution. No concrete timeline or tokenomics have been finalized.

The proposed token aims to incentivize developer and user participation, aligning with Base's Ethereum-based LAYER vision. Since its 2023 launch, Base has amassed $5 billion in total value locked, yet relies on ETH for gas fees. Pollak stressed the ideation remains fluid, with decisions to be made transparently.

Ethereum Faces Seasonal Headwinds as Profit-Taking Risks Emerge

Ether's 7.6% weekly gain to $4,620 masks growing concerns among analysts. September's historical -12.7% median return for ETH looms large, with on-chain metrics now flashing warning signs. The profit supply metric hit 99.68% on September 12—a level that preceded August's 9% correction when similar conditions last appeared.

Futures market sentiment reinforces the cautionary outlook. The taker buy-sell ratio dipped to 0.91 on September 13, marking the second-weakest reading this month. Such technical deterioration often precedes pullbacks, particularly during Ethereum's seasonally weak period.

Ethereum MVRV Nears 2.0 as Bulls Defend $4,700 Price Range

Ethereum's recent surge underscores its dominance in the altcoin market, with a 9% weekly gain propelling ETH toward the $4,700 threshold. The rally reflects growing institutional confidence and favorable macroeconomic tailwinds for digital assets.

On-chain metrics suggest room for further upside. The MVRV ratio—a key indicator of market cycles—remains below historical peaks that typically precede major corrections. Traders are watching for sustained momentum above $4,665, current support level.

Daily volumes show modest profit-taking but no structural weakness. The market appears to be consolidating before its next directional move, with derivatives data indicating balanced positioning between bulls and bears.

Ethereum's Untapped Potential to Displace Wall Street Infrastructure

Ethereum's capacity to overhaul Wall Street's antiquated settlement systems remains significantly undervalued by investors, according to industry leaders. Joseph Chalom, CEO of SharpLink and former BlackRock digital asset executive, alongside EigenLayer founder Sreeram Kannan, highlighted this disconnect during a recent Milk Road podcast.

Traditional finance suffers from sluggish settlement times, counterparty risks, and costly collateral requirements—inefficiencies that intermediaries exploit for profit. "The current ecosystem is riddled with friction and gatekeepers extracting rents," Chalom noted. Ethereum's atomic settlements eliminate these pain points, executing transactions in seconds without third-party risk.

The blockchain emerges as a foundational public infrastructure akin to the early internet, capable of serving as a universal settlement layer. Its programmable nature enables instant portfolio rebalancing through smart contracts, near-instant dividend distributions, and frictionless asset composability—features that could redefine global finance.

MetaMask Unveils Native Stablecoin mUSD to Enhance Liquidity

MetaMask, a leading Ethereum-based digital asset wallet, has launched its own stablecoin, MetaMask USD (mUSD). The dollar-pegged asset is designed to bolster liquidity within the MetaMask ecosystem and will be compatible with the platform's services, including the MetaMask Card. Initially issued on Ethereum and Linea, an EVM layer-two scaling solution, mUSD aims to provide low-cost fiat on-ramps for users.

The stablecoin's development involved collaboration with M0 Protocol and Bridge.xyz. Early metrics show a market cap of $20.3 million and trading volume of $32.35 million. Regulatory tailwinds, including the U.S. GENIUS Act, could accelerate adoption among MetaMask's substantial user base.

Ethereum Exit Queue Hits $12 Billion Amid Market Uncertainty

Ethereum's validator exit queue surged to a record $12 billion in September 2025, triggering intense speculation about the health of its proof-of-stake ecosystem. The unprecedented outflow raises questions about whether this represents a systemic shift or temporary repositioning among stakers.

The transition to Ethereum 2.0 in 2022 promised greater scalability and sustainability, but current validator behavior suggests growing pains in the PoS model. Network stability concerns emerge as substantial ETH holdings enter the withdrawal pipeline, though some analysts frame this as strategic portfolio rebalancing rather than loss of confidence.

Is ETH a good investment?

ETH presents a compelling investment opportunity based on current technical and fundamental analysis. The cryptocurrency is trading above key technical levels with strong institutional developments supporting long-term growth potential.

| Metric | Current Value | Signal |

|---|---|---|

| Current Price | $4,506.30 | Bullish |

| 20-day MA | $4,417.53 | Support Level |

| Upper Bollinger | $4,673.48 | Resistance Target |

| MACD | -1.86 | Consolidation |

BTCC financial analyst Emma suggests: 'ETH's position above the 20-day moving average combined with growing institutional adoption creates a favorable risk-reward scenario for investors with a medium to long-term horizon.'